Introduction

In today’s world, individuals often feel pressured to convey an image of affluence. You’ve probably observed on social media how some people showcase their luxurious cars, extravagant vacations, and gourmet dining experiences. It might appear that opulence necessitates extravagant spending, but the reality is more nuanced.

Are they genuinely affluent, or does the ostentatious display truly signify wealth? Well, this isn’t always the case. Authentic prosperity isn’t always conspicuous and flamboyant. In reality, many extremely wealthy individuals opt not to flaunt their wealth despite possessing substantial assets.

Being genuinely affluent isn’t about ostentation; it’s about amassing wealth and employing it judiciously. Today we’ll delve into why affluent individuals occasionally maintain a low profile, their motivations for doing so, and the financial strategies that give them an advantage over others.

Reason 1

Wealthy individuals understand the value of money.

Astute investors—those who excel in financial matters—appreciate assets that appreciate over time. They view these assets as pivotal to their financial security. Instead of squandering their resources on displays of extravagance, they make decisions that foster long-term financial growth. Achieving financial independence isn’t solely about appearing affluent; it’s about making shrewd financial moves, such as investing in stocks, owning a share in a business, and diversifying their investments.

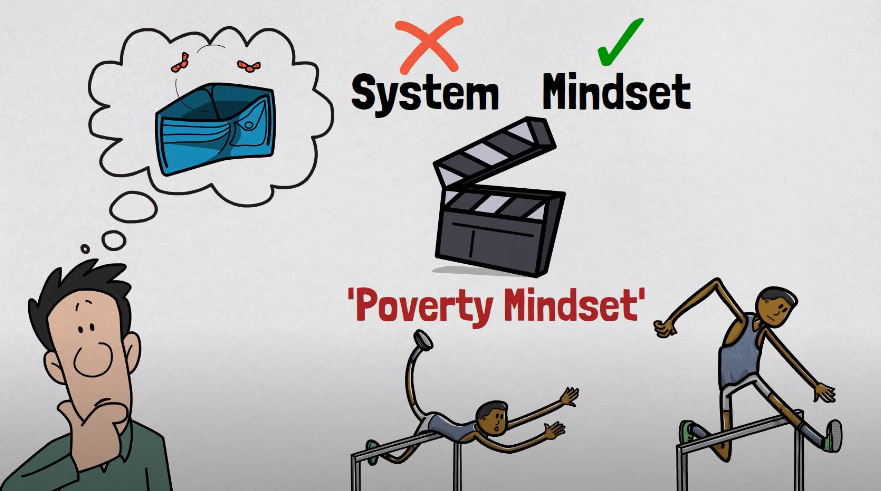

Their assessment of affluence doesn’t hinge on their possessions but on the growth of their wealth and their adept financial management. Rich individuals don’t regard money in the same way as the majority. The key distinction between those who have substantial wealth and those who don’t often boils down to their perspective on money.

Discerning individuals select investments that appreciate over time, while others fritter away their funds without deliberation. These different mindsets are fundamental to understanding why some people amass wealth while others grapple with financial problems.

So how can someone facing financial difficulties transform their situation and attain financial success? It begins with altering their perspective on money. Money serves not only to make purchases or settle bills but also as a tool for generating even more wealth.

Reason 2

Low-key approach and privacy

To savor a regular life, some affluent individuals prefer to preserve a semblance of normalcy in their lives. They derive contentment from modest pleasures and daily routines without the distractions associated with an extravagant lifestyle. By low-key, I mean that some people maintain modesty and refrain from showcasing their wealth.

Consider this scenario: if you abstain from drawing attention to yourself with lavish possessions, others will remain oblivious to your financial dealings, reducing unwanted scrutiny. This allows you to pursue your goals without undue external interference.

They seldom flaunt their wealth because they comprehend the effort required to amass it. Instead, they concentrate on augmenting their wealth. Consider this example: contemplate renting a luxury sports car like a Ferrari for a day. In the United States, this can cost between $1,500 and $33,000.

Many wealthy individuals actually rent such cars to individuals who simply want to flaunt their affluence. These individuals expend money to create the appearance of wealth, thereby enriching the already wealthy person. The question is, who is truly benefiting from this scenario?

Now what distinguishes affluent individuals from those less well-off is that if you begin flaunting your wealth, certain issues emerge. The moment you display your prosperity, friends and relatives may solicit financial aid. It’s not inherently wrong to assist them, but at times they may become excessively dependent on you.

Furthermore, criminals and thieves often target wealthy individuals. Let’s not disregard pseudo-friends who may emerge from various quarters, solely interested in your wealth. It becomes challenging to discern genuine concern for you as an individual. Genuinely prosperous individuals focus on inconspicuously nurturing their wealth. This isn’t an effortless journey. You may not receive lavish praise, and your social circle may diminish, but those who remain are true friends.

You might now be pondering why some influencers flaunt their wealth. It’s for branding and marketing purposes. This facilitates the construction of a substantial audience, enabling them to subsequently market courses that enhance their prosperity. The critical aspect is that they wouldn’t display things they couldn’t genuinely afford, particularly when they were less affluent. They have a rationale behind their actions, and it’s to augment their wealth. So what’s your rationale for flaunting your wealth, apart from projecting affluence? Seris, there isn’t much of a rationale at all.

Reason 3

Personal well-being

The pursuit of an opulent lifestyle can often lead to stress, anxiety, and a dearth of personal well-being. Some affluent individuals prioritize their mental and emotional health over extravagant expenditures. Wealthy individuals cultivate astute habits that facilitate wealth accumulation. It’s not magic; it’s about making prudent decisions that yield substantial dividends.

Primarily, they’ve mastered the art of delayed gratification. Rather than hasty decisions, they exercise patience, which aids them in accumulating resources for truly significant investments as opposed to impulsive purchases. Second, they persistently invest in self-improvement.

They are avid readers, delving into books to sharpen their minds and enhance their financial acumen. Nevertheless, they don’t simply read; they actively implement the knowledge gleaned from these books.

Last but not least, they prioritize their physical well-being. They engage in physical activity and maintain their health because they understand that when you feel well, your cognitive abilities are enhanced.

What’s the point of amassing wealth if you’re not in good health? These habits may appear elementary, yet they are the cornerstones of a brighter future. This is what distinguishes wealthy individuals and aids them in attaining membership in the 1% Club. They prudently save and invest for the future while being relatively unconcerned with external opinions.

When you are genuinely confident in your wealth, the urgency to demonstrate it to others dissipates. The idea is that when you acknowledge your success, there’s little need to go to great lengths to display it.